24+ mortgage interest taxes

Ad Calculate Your Payment with 0 Down. For 2019 about 13.

Section 24 Landlord Tax Scam What Can You Do About It Youtube

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

. 15 2017 can deduct interest on loans up to 1 million. Web M monthly mortgage payment. If you got a mortgage on or after Dec.

NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre. P the principal amount.

Web A 15-year fixed-rate mortgage with todays interest rate of 632 will cost 861 per month in principal and interest on a 100000 mortgage not including taxes and insurance. However basic rules and limitations apply. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each.

13 1987 and before Dec. A mortgage calculator can help you determine how much interest you. Web Tax break 1.

Web Most homeowners can deduct all of their mortgage interest. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs on them.

Homeowners who are married but filing separately may be allowed to deduct up to the. Web Home mortgage interest. Homeowners with a mortgage that went into effect before Dec.

I your monthly interest rate. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay.

For example Lenas first-year interest expense totals 14857. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Thats a maximum loan amount of roughly 253379.

Just remember that under the 2018 tax code new homeowners. Web About Form 1098 Mortgage Interest Statement Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual including a sole proprietor. Web Is mortgage interest tax deductible.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Homeowners who bought houses before December 16 2017 can deduct. Single filers get half those amounts.

Web In this example you divide the loan limit 750000 by the balance of your mortgage 1500000. Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid when you finance or refinance your home. Web Mortgage interest is tax deductible.

Since you may be deducting mortgage points over the course of 30 years keep these files on hand for the. Web Joes total monthly mortgage payments including principal interest taxes and insurance shouldnt exceed 1400 per month. Web If you got your mortgage after Oct.

16 2017 the limit is 1 million 500000 if you and a spouse are filing separately. 16 2017 then its tax-deductible on mortgages of up to 1 million. Web Homeowners filing taxes jointly can deduct all payments for mortgage interest on loans up to 1 million or loans up to 750000 if made after Dec.

As with property taxes you can deduct the interest on your mortgage for the portion of the year you owned your home. Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules. Lets say you paid 10000 in mortgage interest and are in the 32 percent tax.

This gives you 05 which you multiply by the total interest payments you made for the year 90000. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to. Web In the example above if your mortgage interest is right around 10000 and your standard deduction is 12400 if single or 24800 if married it might make more sense to not itemize and thus forgo the mortgage interest deduction.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. 16 2017 the limits are 1 million. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

However for acquisition debt incurred. The amount you can claim as your mortgage interest tax. Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage.

Answer Simple Questions About Your Life And We Do The Rest. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest. Ad Calculate Your Payment with 0 Down. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Mortgage interest. At a personal tax rate of 24 this implies tax savings of 3566 in just the first year of.

What Is Section 24 Also Known As The Tenant Tax Alan Hawkins

Section 24 Buy To Let Tax Relief Rules Explained

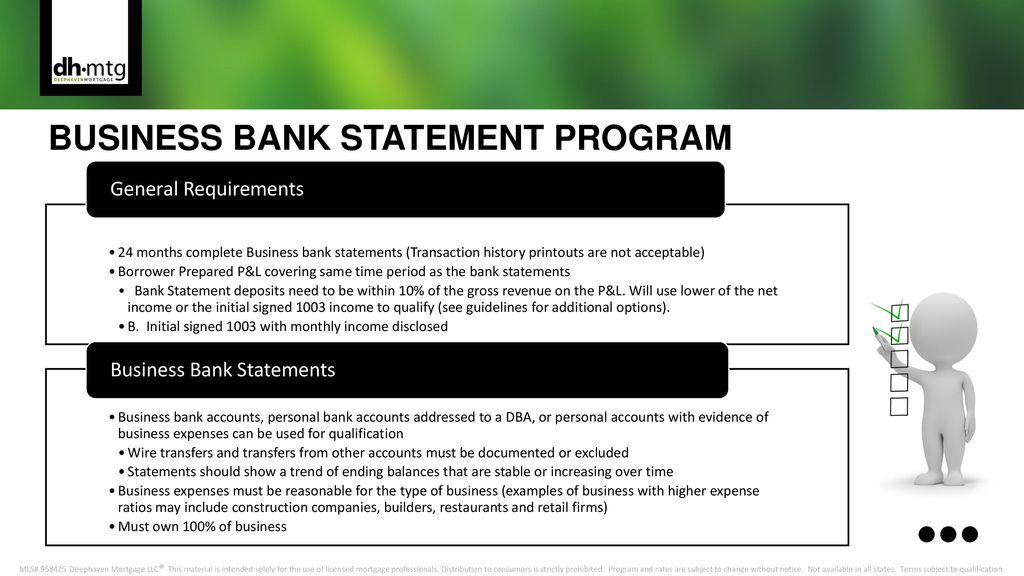

Delegated Underwriting Training Ppt Download

Section 24 Changes To Mortgage Interest Relief

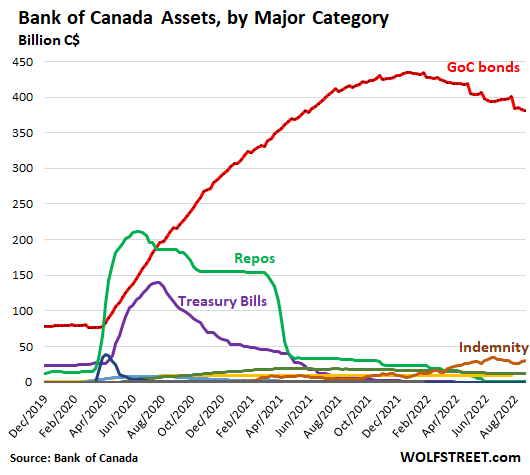

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

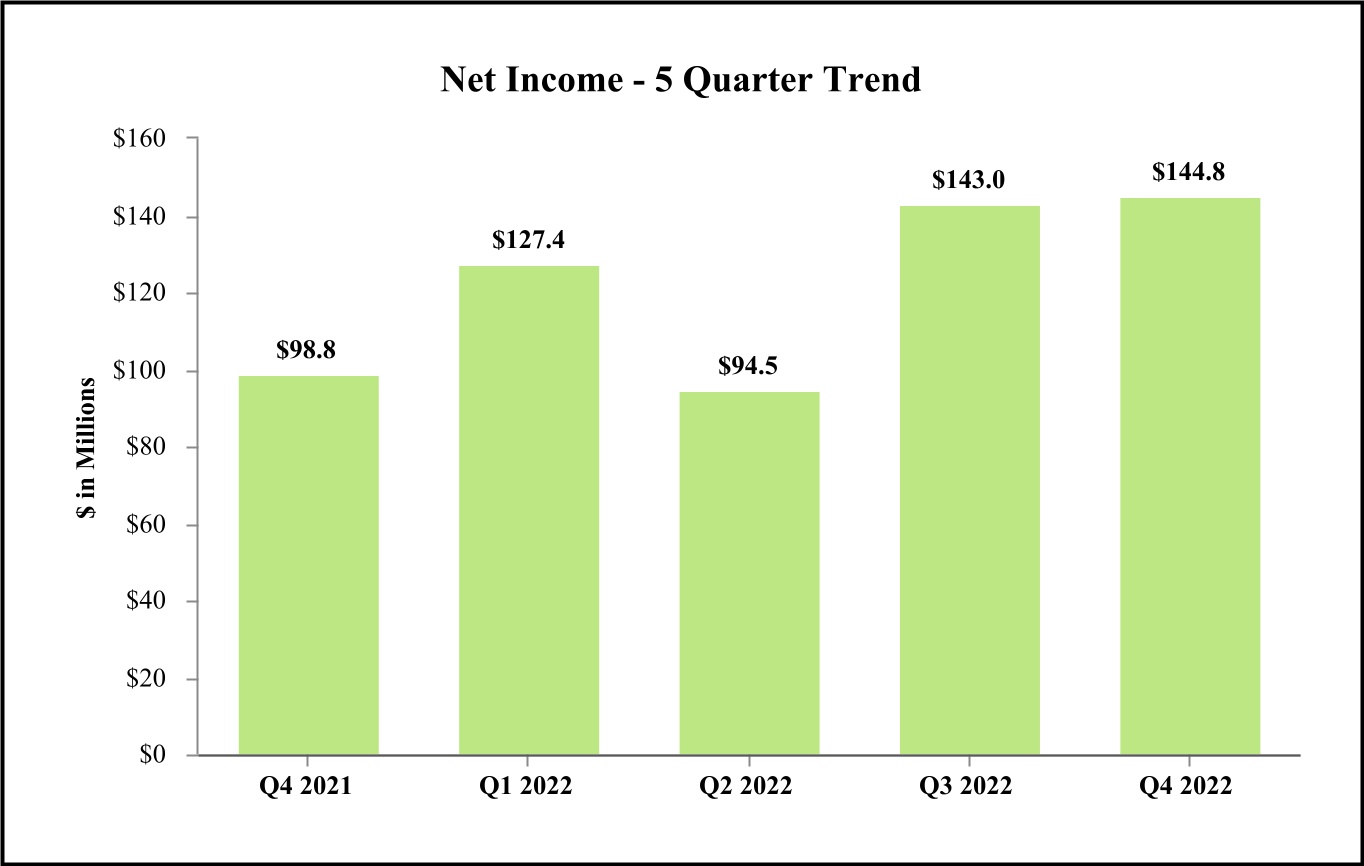

Document

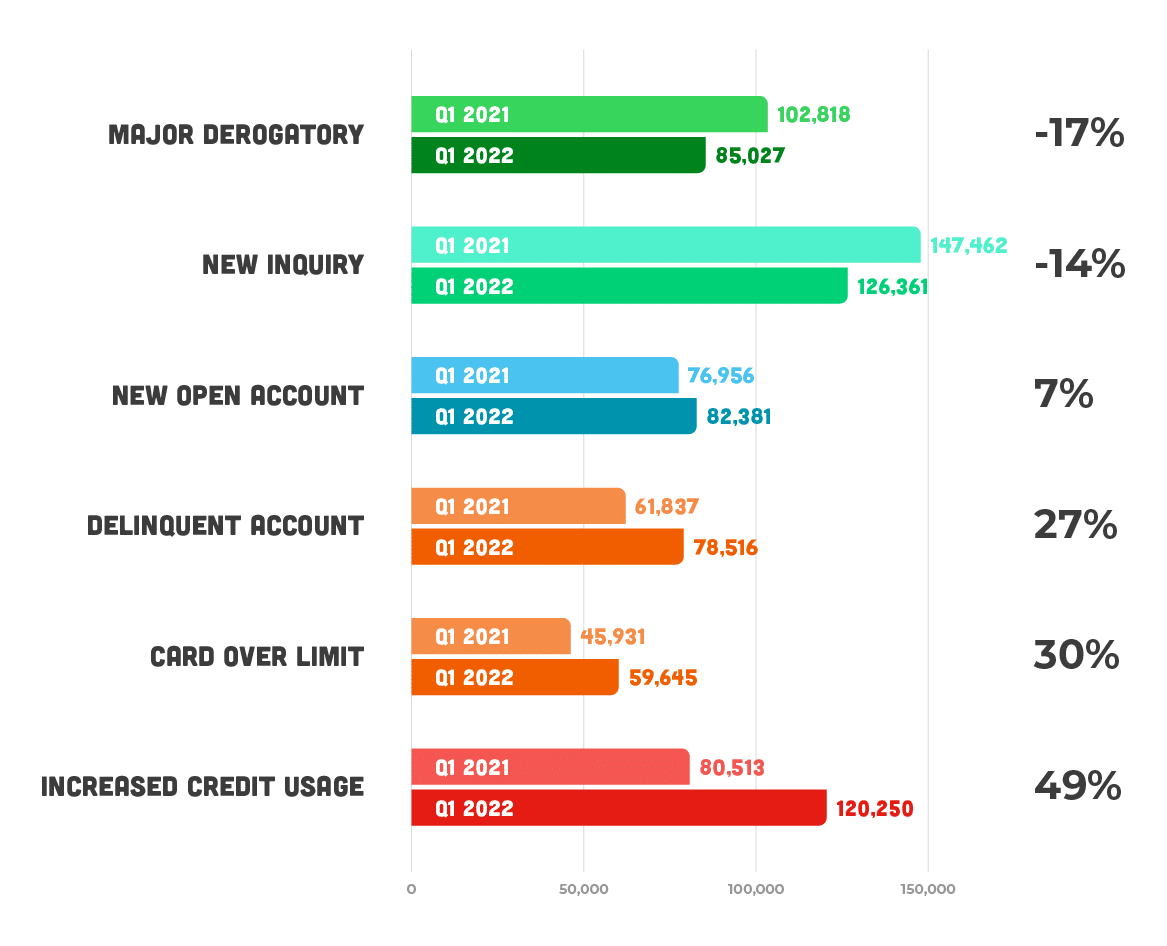

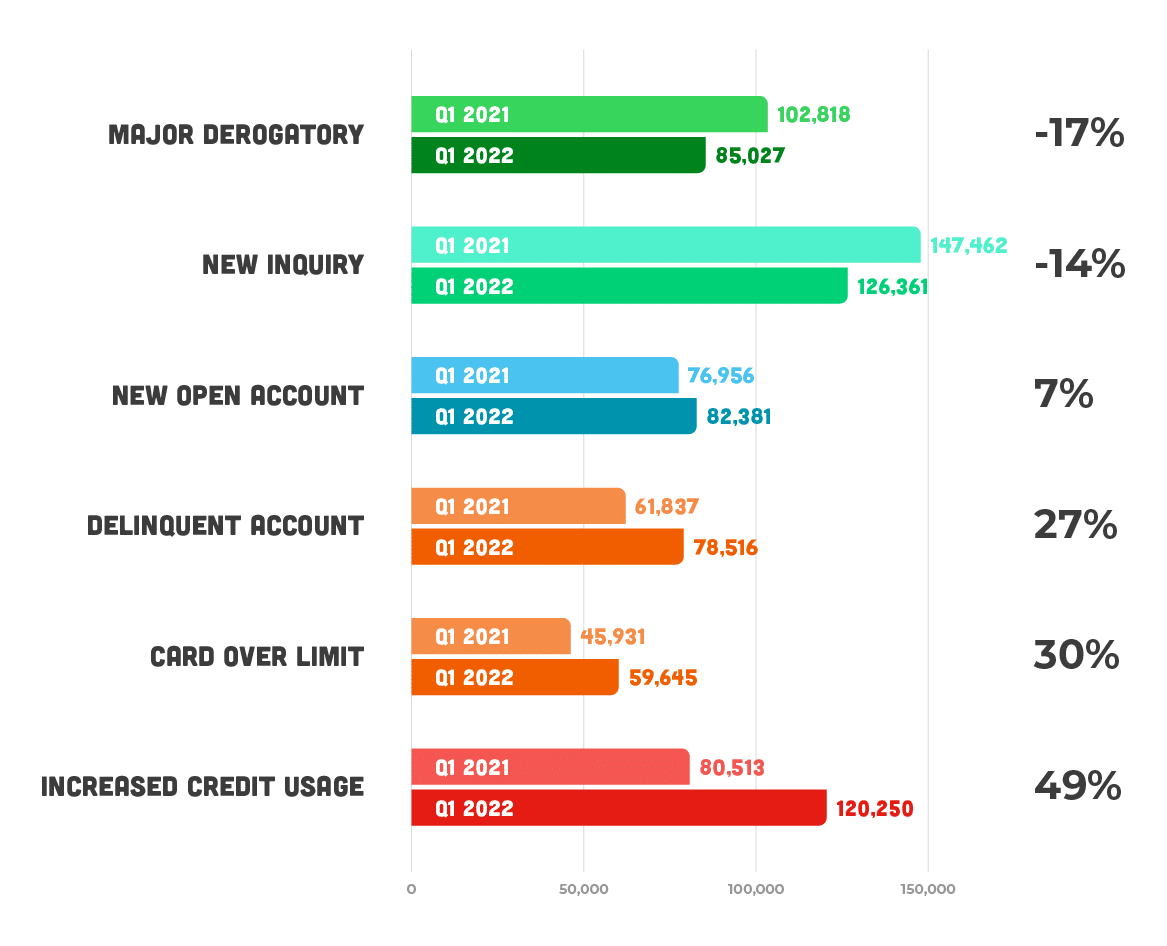

Scoresense Survey Report Homebuyer Sentiment And Credit Outlook Analysis Scoresense

Mortgage Interest Deduction A Guide Rocket Mortgage

Your Guide To Section 24 What Is Section 24 How To Manage It

What Is Section 24 Also Known As The Tenant Tax Alan Hawkins

Saving On Mortgage Taxes Mortgages The New York Times

Document

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

Wholesale Equity Solutions Lender And Investor Aaa Lendings

Section 24 Buy To Let Mortgage Property Tax Youtube

Section 24 Mortgage Interest Tax Relief Comfort Letting Agents Llp

What Is Section 24 Common Questions About Mortgage Interest Tax Relief Restrictions Less Tax For Landlords